Getty Images

How to train agents on call center fraud detection

Poorly trained call center agents are easy targets for bad actors. Organizations must prepare for call center fraud with proper agent training and anti-fraud technologies.

Call center fraud is a reality that organizations must prepare for or risk considerable losses in time and money.

Organizations can drastically mitigate their vulnerability with the right blend of comprehensive agent training, well-documented processes and technology for call center fraud detection. To begin, call center staff needs to understand the key components of fraud detection, including the following:

- incentives behind call center fraud;

- popular fraud methods;

- tips for training agents in fraud detection; and

- technologies that help agents identify fraud.

Why do bad actors target call centers?

Call centers are popular targets for fraud because poorly trained agents are often vulnerable to manipulation. Unsuspecting agents make excellent attack vectors, as they are all that stand between a fraudster and customer accounts. Also, the call center's toll-free number can allow bad actors to easily and freely initiate numerous fraud attempts while maintaining anonymity, provided they use caller ID spoofing techniques.

The COVID-19 pandemic has also negatively affected fraud detection preparedness. Remote work has made it increasingly difficult for agents to receive proper fraud detection training or guidance from co-workers. As a result, they may struggle with remotely using anti-fraud tools.

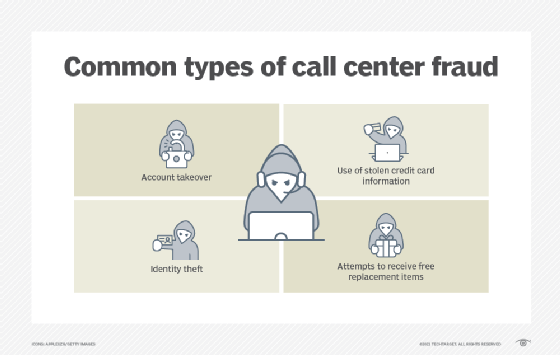

Common types of call center fraud

While call centers face many types of fraud, the most common are identity theft, account takeover, stolen credit card information and attempts to receive free merchandise.

Identity theft. This fraud occurs when bad actors use stolen personal information of legitimate customers to access accounts for monetary gain. Agents may struggle to detect identity theft because the bad actors have accurate customer information.

Account takeover. This fraud involves attempts to transfer a customer account to the bad actor, who may change email address or login information to reset customer portal passwords.

Use of stolen credit card information. Fraudsters bombard call centers with attempts to buy goods and services with stolen credit card information. Because call centers don't require physical cards, bad actors can more easily make purchases with stolen information.

Attempt to receive free replacement items. Bad actors act as legitimate customers who purchased goods, then claim to have problems and request replacements. Retailers are the most common victims of this fraud, especially those with loose warranty and replacement policies.

Tips for identifying fraudulent callers

Bad actors use different fraud methods depending on their motivation or the type of call center business they target.

Common signs of fraud include the following:

- social engineering methods

- inability to answer questions

- long pauses before answering questions

- overly emotional conversations meant to evoke a reaction

- attempts to establish a relationship or rapport with a specific agent or manager

- inconsistency with customer history and documentation

- attempts to bypass customer service procedures

- suspicious activity that anti-fraud technologies identified

- attempts to bypass anti-fraud processes and technologies

Tools to identify fraud

Organizations that take call center fraud detection and prevention seriously shouldn't rely solely on agent training. Call center managers can integrate several technologies into most on-premises or distributed workforce call centers to enhance fraud detection.

Call source analytics. Emerging technologies can more accurately confirm a call's true source, as well as the type of device used. These attributes can tip off call center agents about whether the caller is a real customer or a bad actor in a known fraud location or using equipment common among fraudsters, such as caller ID spoofing and interactive voice response (IVR) probing tools.

Multilayered authentication. Multifactor authentication, AI and knowledge-based platforms can identify bad actors who impersonate legitimate customers. The technology platform inputs various data points and calculates a fraud risk score to inform the agent about next steps in the fraud prevention process.

Voice biometrics. Advanced audio biometrics can analyze a caller's voice, creating a new authentication layer for call centers and customers. Voice biometric SaaS providers let remote agents access these authentication services regardless of where they work.

Suspicious behavior detection. AI and machine learning techniques combine with fraud detection analytics tools to detect suspicious behavior, such as unusual calling patterns, IVR usage anomalies and other behavior-based indicators. The tool then decides if the call is legitimate or not.